THEBUSINESSBYTES BUREAU

NEW DELHI, SEPTEMBER 3, 2025

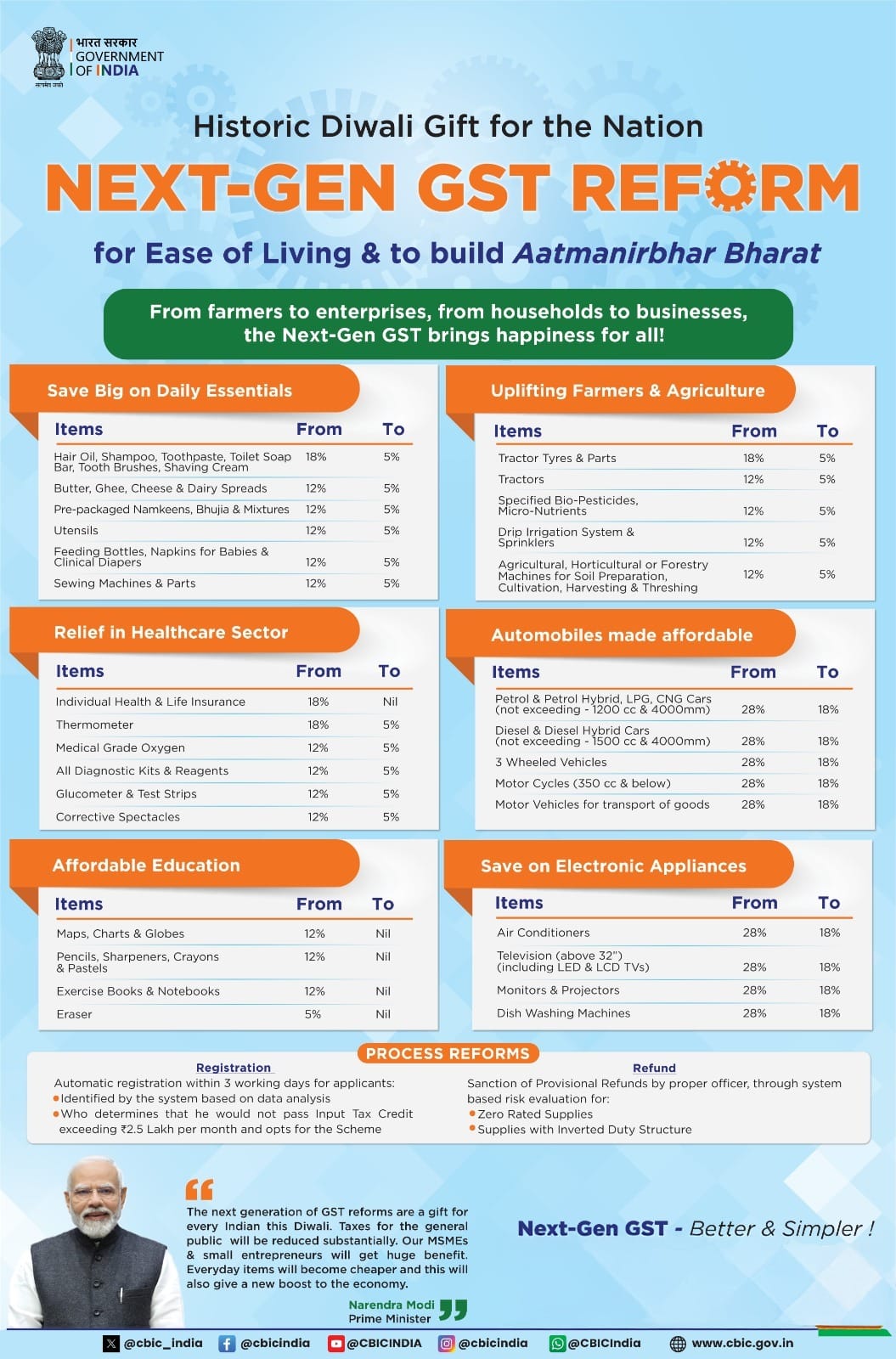

In a landmark overhaul of India’s indirect tax system, the Goods and Services Tax (GST) Council at its 56th meeting in New Delhi on Wednesday approved sweeping reforms that simplify the tax structure, slash rates across critical sectors, and provide direct relief to households, industries and small businesses.

Chaired by Union Finance & Corporate Affairs Minister Nirmala Sitharaman, the meeting ratified the “next-generation GST reforms” envisioned by Prime Minister Narendra Modi in his Independence Day address, signalling a decisive shift towards a simpler, citizen-friendly, and growth-oriented tax regime.

At the core of the reforms is a rationalisation of the existing four-tier GST structure into a streamlined “Simple Tax” framework, comprising a merit rate of 5% and a standard rate of 18%, with a de-merit rate of 40% retained for a narrow band of luxury and sin goods. Analysts say this simplification will reduce classification disputes, ease compliance and improve revenue buoyancy by expanding the tax base.

Insurance and healthcare emerged as the biggest gainers. All life insurance and health insurance policies, including family floaters and senior citizen covers, have been fully exempted from GST — a move aimed at deepening insurance penetration and reducing out-of-pocket expenditure. Further, 33 life-saving drugs have been made GST-free, while the rate on a wide range of medicines and medical devices has been slashed to 5%, substantially lowering treatment costs.

Insurance and healthcare emerged as the biggest gainers. All life insurance and health insurance policies, including family floaters and senior citizen covers, have been fully exempted from GST — a move aimed at deepening insurance penetration and reducing out-of-pocket expenditure. Further, 33 life-saving drugs have been made GST-free, while the rate on a wide range of medicines and medical devices has been slashed to 5%, substantially lowering treatment costs.

Consumer-facing sectors saw sweeping rate cuts designed to spur demand. GST on daily-use items such as soaps, shampoos, toothpaste, bicycles, and kitchenware has been reduced to 5%. Essential foods including UHT milk, paneer and Indian breads like roti and paratha will now be tax-free, while packaged snacks, noodles, chocolates, coffee, butter and ghee will attract only 5%.

The agriculture and rural economy received a significant push with GST on tractors, harvesters and soil preparation machinery cut from 12% to 5%, while fertilizer inputs such as sulphuric acid and ammonia were reduced from 18% to 5%, correcting inverted duty structures. Similarly, labour-intensive sectors such as handicrafts, leather goods, and natural stone products have been brought under the 5% bracket.

The reforms also carry far-reaching implications for core industries. Cement, a critical input for infrastructure and housing, will now attract 18% instead of 28%. Automobiles and mobility segments saw broad-based relief, with small cars, two-wheelers below 350cc, buses, trucks and ambulances moved to the 18% slab. Auto components will face a uniform 18% rate, eliminating persistent classification disputes. Renewable energy devices too have been moved down to 5%, providing a cost boost to India’s clean energy transition.

On the services front, hotel accommodation below ₹7,500 per night has been reduced to 5%, a move expected to support domestic tourism, while gyms, salons, barbers and yoga centres — services heavily used by the middle class — also shift to the 5% bracket.

The Council also cleared the long-delayed Goods and Services Tax Appellate Tribunal (GSTAT), which will become operational by September-end and commence hearings by December, providing long-awaited relief in tax dispute resolution. Service rate changes will take effect from September 22.

Industry watchers said the measures strike a balance between revenue considerations and consumption stimulus. “The structural simplification coupled with aggressive rate rationalisation is likely to boost compliance, expand coverage, and revive consumption demand, particularly in rural and middle-class segments,” said a tax expert with a leading consultancy.

With the latest reforms, GST — once seen as a complex levy — is being positioned as a strategic tool to support India’s growth ambitions while enhancing affordability for households. Analysts expect the moves to spur demand in FMCG, healthcare, auto, and housing, while aligning with broader policy goals of insurance penetration, renewable energy adoption, and ease of doing business.

THEBUSINESSBYTES.COM Fast. Focused. Future-ready

THEBUSINESSBYTES.COM Fast. Focused. Future-ready

Leave a Reply