TBB BUREAU

MUMBAI, JAN 05, 2024

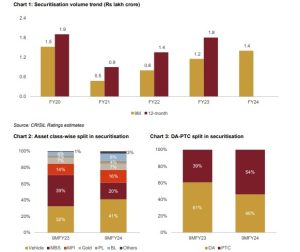

Notwithstanding the exit of one of the largest housing finance company (HFC) originators in the second quarter of the current fiscal (FY2023-24), Securitisation volume continued on its upward momentum, surging 20 per cent on-year to Rs 1.4 lakh crore in the first nine months of FY24, a CRISIL report said on Friday. If one were to adjust for the HFC volume and consider only securitisations by other originators, the market grew by a whopping 40 per cent on-year, it added.

The rise and spread of the market is expected to continue, given expected healthy credit growth among NBFCs, the retailisation agenda of banks that are the largest investors in the market, and the recent regulatory guidelines on risk weights by the Reserve Bank of India (RBI).

The rise and spread of the market is expected to continue, given expected healthy credit growth among NBFCs, the retailisation agenda of banks that are the largest investors in the market, and the recent regulatory guidelines on risk weights by the Reserve Bank of India (RBI).

“Growth momentum in securitisation is expected to remain strong as NBFCs look to further diversify their resource mix, especially given the increased risk weights for banks’ loan exposures to NBFCs. In the first nine months of this fiscal, we have already seen the market widen with the number of originators crossing 135 as compared to 120 in the corresponding period last fiscal,” said Ajit Velonie, Senior Director, CRISIL Ratings.

The pass-through certificate (PTC) route accounted for 54 per cent of the overall volume and direct assignment (DA) transactions comprised the rest. Among asset classes, vehicle loans (including commercial vehicles, passenger vehicles and two-wheelers) cornered the biggest share (41 per cent; up from 32 per cent in the first nine months of last fiscal), followed by mortgages (20 per cent) and microfinance (16 per cent).

The volume of personal and business loan securitisations doubled (13 per cent of volume), with 230 pools securitised by 55 originators in the first nine months of this fiscal, compared with 150 pools securitised by 45 originators in the corresponding period of the previous fiscal.

In terms of the investor base, private banks dominated the market, accounting for 46 per cent of volume, followed by public sector banks (25 per cent) and foreign banks (14 per cent). Participation by other investors such as mutual funds also increased, as they explore securitisation to diversify their investments and enhance risk-adjusted returns.

The third quarter also saw foreign banks eyeing investments in the microfinance space through the PTC channel to meet their priority-sector-lending requirements. The robust performance of past securitised pools has been an important factor in propelling investor confidence in microfinance and other unsecured asset classes. PTCs rated by CRISIL Ratings had median monthly collection ratios (MCRs) of 98-100 per cent in secured asset classes and microfinance, and 94-96 per cent in unsecured asset classes.

The market also exhibited wider acceptance for replenishing structures. PTC transactions of over Rs 2,500 crore were structured with pre-defined replenishment periods, wherein the collections from the underlying pool are used to purchase new loan assets instead of amortising the PTCs, thereby elongating instrument durations to meet the tenure requirements of investors. Such transactions were seen across asset classes, from microfinance to vehicle, personal and business loans.

Overall, the securitisation market continues to expand with more originators and newer transaction structures finding wider acceptance. Given the continued growth and strong performance track record of securitisations, more new structures are expected to find their way into the market, enabling better alignment with investor requirements and market deepening.

The Business Bytes

The Business Bytes