TBB BUREAU

MUMBAI, JUNE 13, 2023

India’s aluminium exports to the European Union (EU) are set to become unviable once the 27-nation bloc implements the Cross-Border Adjustment Mechanism (CBAM) to help reduce its carbon emissions and eventually attain Net-Zero carbon emissions by 2050, a CRISIL report says.

Under CBAM, which takes effect in a few months — the transition phase is expected to start from October 1, 2023 — and would be applicable to iron and steel, cement, aluminium, fertilisers, and electricity to start with, importers in the EU must declare the embedded carbon emissions in goods on a quarterly basis.

Though a 100% free allowance will be applicable initially, starting 2026, it will be gradually phased out, and completely removed by 2034. After this period, everything above the allowance will be taxed based on Emissions Trading System (ETS) weekly prices, the report says.

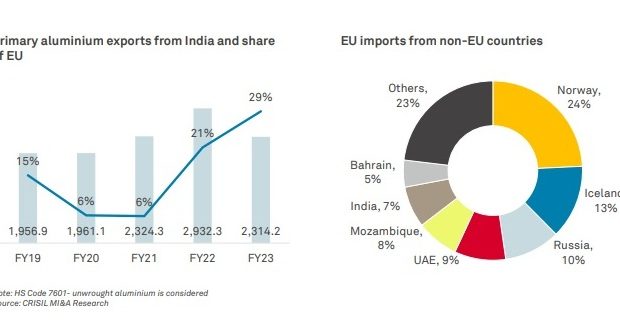

That bodes ill for Indian aluminium manufacturers. India produces 4.1 million tonnes (MT) of primary aluminium annually — amounting to 6% of global production — of which as much as 56%, or 2.3 MT, is exported. It is one of the lowest-cost producers of aluminium globally owing to integrated operations and low costs of power generation since it uses coal-based captive plants.

The EU is not only India’s second-largest trading partner, but also an attractive destination for aluminium exports. In FY2023, primary aluminium accounted for as much as 29% of the total $74.8 billion of merchandise exports from India to the EU.

As such, primary aluminium production is one of the most energy-intensive processes in the metals and mining industry.

Worldwide, manufacturers require 13,500–14,500 kWh of energy to produce 1 tonne of primary aluminium. The resulting carbon emissions are a direct coefficient of the energy source utilised for the process. The higher the emissions from an energy source, the higher the environmental impact.

Globally, China is the largest aluminium producer with a 59% production share. It has one of the highest greenhouse gas (GHG) intensities, of 17-18 tonne CO2 per tonne of aluminium (tCO2/t Al), since over 80% of the power requirement is met through coal-based power plants.

In comparison, Europe has one of the lowest GHG intensities, at 6-7 tCO2/t Al, since 93% of the requirement is met through hydropower.

However, India produces aluminium using coal-based captive plants, thus sitting at the opposite end of the spectrum when it comes to emissions. The average GHG emission intensity of the domestic aluminium industry is one of the highest globally, at 21-22 tCO2/t Al.

During the initial phase of CBAM, exports to the EU will likely remain stable since domestic manufacturers like Vedanta and Hindalco have strong GHG reporting standards, which will fulfil the requirement until 2025-end.

However, when the tariffs kick in from 2026, primary aluminium producers exporting to Europe will have to buy EU-ETS certificates for the emissions; these do not fall under free allowance.

Post 2026, with free allowances tapering, exports are expected to become unviable for domestic players. The GHG emission intensity gap between Europe and India is 14–15 tCO2/t Al currently, which will lead to an incremental cost of $1,500-1,600 per tonne of aluminium.

India will be hit hard by CBAM as it has one of the highest emission intensities among major exporters. Indian manufacturers are currently competing with those in the Middle East, Canada, Norway, and Iceland, which have significantly lower emissions.

Domestic manufacturers such as Vedanta, Hindalco and NALCO have announced initiatives to reduce GHG emissions. While Vedanta has stated it will lower absolute emissions by 25% by 2030, compared with FY2021, Hindalco has set a target to reduce specific GHG emissions by 25% by 2025 against fiscal 2012 levels. NALCO has allied its target with India’s aim of reducing GHG emissions, increasing the share of non-fossil power sources to 40% by 2030.

However, despite taking active measurements to reduce emissions, domestic manufacturers are unlikely to bridge the steep emission intensity gap significantly owing to coal-based power generation. The European market will be unviable despite domestic players lowering emissions intensity by 20–25% by FY2030.

CBAM will lead to a significant 20% rise in prices due to the stark difference in emission intensities between key producing countries such as China and India and Europe. Given that 67% of the global power requirement for aluminium production is met by coal- or gas-based power plants, exports from all geographies to Europe are set come under intense scrutiny. No new capacity additions are taking place in Europe; hence, it will remain import-dependent, driving prices higher.

Indian primary aluminium producers are expected to divert their produce to other developing economies such as Southeast Asia, Africa and even China to try and bridge this revenue shortfall.

The Business Bytes

The Business Bytes