TBB BUREAU

MUMBAI, JUNE 01, 2023

Assets under management (AUM) of non-banking financial company-microfinance institutions (NBFC-MFIs) is set to grow 25-30 per cent this fiscal amid improving asset quality and continued traction in economic activity, said a CRISIL Report on Thursday. Complementing these tailwinds will be rising profitability supported by higher net interest margins. The confluence of these factors augurs well for the credit profiles of NBFC-MFIs, it added.

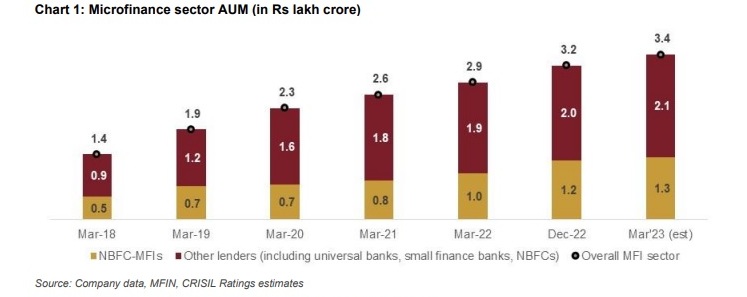

Overall, the microfinance sector’s AUM is estimated to have crossed Rs 3.4 lakh crore as of March 2023, with NBFC-MFIs outpacing small finance banks, universal banks and other lenders.

NBFC-MFIs now have the largest lending footprint in microfinance with an AUM of Rs 1.3 lakh crore. The growth has come on the back of pent-up demand for credit and increase in ticket-size of disbursements (up 10-15 per cent across loan cycles over the past two fiscals).

“The market share of NBFC-MFIs in microfinance credit rose 700 basis points in 33 months to 38 per cent as of December 2022 from 31 per cent as of March 2020. Their focus on intra-state penetration has meant top five states now comprise over half of the industry AUM. Bihar has the largest share at 12.7 per cent, followed by Tamil Nadu (11.1 per cent) and Karnataka (10 per cent),” said Ajit Velonie, Senior Director, CRISIL Ratings.

The growth in AUM has been accompanied by improvement in asset quality, as reflected in stressed assets (gross non-performing assets + restructured assets) falling to 6 per cent in December 2022 from a peak of 13 per cent in September 2021, and to an estimated 3 per cent as of March 2023.

NBFC-MFIs have been cleaning up their pandemic-impacted loan books through write-offs and sale to asset reconstruction companies through last fiscal. This, coupled with lower slippages in recent originations, has helped bring down their stressed assets level.

Overall, profitability — measured by return on managed assets — is expected to exceed 3 per cent in fiscal 2024, versus 1 per cent in fiscals 2021 and 2022 and 1.5-2.0 per cent in fiscal 2023. The improvement will be driven by adoption of risk-based loan pricing and improved credit underwriting, which would lead to higher margins and lower credit costs, respectively.

Credit costs, which had peaked at 4-5 per cent in the past two fiscals because of the pandemic-related challenges, have started to stabilise and fell to 3.0-3.5 per cent (annualised) during the first nine months of fiscal 2023. It should fall further to 2.0-2.5 per cent this fiscal because a chunk of AUM now comprises disbursements made in the past 12-15 months and these have exhibited strong collection efficiency of 98-99 per cent. This reflects restoration of cash flows of underlying borrowers after the pandemic-driven liquidity constraints. Continued strengthening of underwriting practices with usage of comprehensive credit bureau report has also helped.

“The average interest yield on portfolios generated in the past 12 months is estimated to have risen by 150-250 bps. The resultant higher net interest margin along with lower incremental credit cost, should lift profitability to the pre-pandemic levels,” said Prashant Mane, Associate Director, CRISIL Ratings.

The Business Bytes

The Business Bytes