THEBUSINESSBYTES

BUREAU

NEW DELHI, JANUARY 29,

2026

India’s

industrial engine is gathering fresh momentum, with the sector’s Gross Value

Added expanding by a robust 7.0 per cent year-on-year in real terms during the

first half of FY2025-26, underscoring a clear acceleration in industrial activity

and reaffirming the economy’s structural strength amid a challenging global

backdrop. The Economic Survey 2025-26, tabled in Parliament on Wednesday by

Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman,

highlights that the rebound marks a notable improvement over the 5.9 per cent

growth recorded in the previous fiscal year, reflecting the cumulative impact

of policy reforms, infrastructure expansion and technology-led transformation

across industries.

The Survey

points to manufacturing as a key growth driver, with Manufacturing GVA rising

by 7.72 per cent in the first quarter and further strengthening to 9.13 per

cent in the second quarter of FY26. This performance, it notes, is rooted in

deeper structural shifts underway within the sector, including a gradual move

towards higher-value manufacturing, improved availability of industrial

infrastructure through corridor-led development, and rising adoption of

technology, digitisation and formalisation across firms. These changes are

reshaping India’s industrial landscape, enabling greater productivity,

efficiency and global competitiveness.

Significantly,

medium- and high-technology activities now account for 46.3 per cent of India’s

total manufacturing value added, a milestone that reflects the growing

sophistication of the country’s industrial base. The Survey attributes this

transformation to targeted government initiatives such as the Production Linked

Incentive schemes and the India Semiconductor Mission, along with the steady

strengthening of domestic capacities in electronics, pharmaceuticals, chemicals

and transportation. This shift has also translated into an improved global

standing, with India’s ranking in Competitive Industrial Performance moving up

to 37th in 2023 from 40th in 2022, signalling rising industrial capability on

the world stage.

Significantly,

medium- and high-technology activities now account for 46.3 per cent of India’s

total manufacturing value added, a milestone that reflects the growing

sophistication of the country’s industrial base. The Survey attributes this

transformation to targeted government initiatives such as the Production Linked

Incentive schemes and the India Semiconductor Mission, along with the steady

strengthening of domestic capacities in electronics, pharmaceuticals, chemicals

and transportation. This shift has also translated into an improved global

standing, with India’s ranking in Competitive Industrial Performance moving up

to 37th in 2023 from 40th in 2022, signalling rising industrial capability on

the world stage.

On the

financing front, while bank-based industrial credit growth from commercial

banks moderated to 8.24 per cent in FY25 from 9.39 per cent in FY24, the Survey

emphasises that this does not reflect a slowdown in overall funding to

industry. Instead, it highlights a diversification of financing sources, with

non-bank financial flows to the commercial sector recording a strong compound

annual growth rate of 17.32 per cent between FY20 and FY25. Quoting the Monthly

Economic Review of August 2025, the Survey notes that the decline in bank

credit coincided with an increase in the overall flow of financial resources to

the commercial sector, pointing to a maturing and broadening financial

ecosystem.

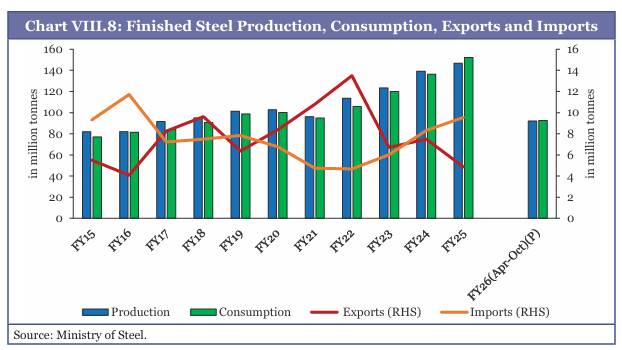

Core

industries have continued to maintain strong momentum, reinforcing the

industrial recovery. India remains the world’s second-largest producer of steel

and cement, with the Survey underscoring the transformative changes witnessed

in the steel sector over the past five years, driven by robust domestic demand

from construction and manufacturing. In cement, India’s per capita consumption

stands at around 290 kg, significantly below the global average of 540 kg,

indicating substantial headroom for growth. The Survey notes that the

government’s sustained focus on mega infrastructure projects—spanning highways,

railways, housing, smart cities and rural development—is expected to

significantly boost cement demand in the coming years.

Energy and

raw material supply has also strengthened, with India’s coal industry reaching

historic levels of production in FY25. Coal output touched 1,047.52 million

tonnes, marking a 4.98 per cent increase over the previous year, providing

critical support to power generation and energy-intensive industries.

Meanwhile, the chemicals and petrochemicals sector continues to play a pivotal

role in industrial development, contributing 8.1 per cent to the overall

manufacturing GVA in FY24, reflecting its importance as a backbone for multiple

downstream industries.

The

automotive sector has emerged as another major growth pillar, recording nearly

33 per cent growth in production over the decade from FY15 to FY25. The Survey

highlights that government-led initiatives to promote electric mobility have

significantly reshaped the industry’s trajectory, leading to a sharp rise in

electric vehicle registrations in recent years. Strategic policy interventions

such as the PLI schemes for automobiles and advanced chemistry cell battery

storage, the PM E-DRIVE scheme, PM e-Bus Sewa Payment Security Mechanism, and

the scheme to promote manufacturing of electric passenger cars have

collectively strengthened domestic manufacturing capabilities and accelerated

the transition towards cleaner mobility.

India’s

electronics sector stands out as a standout success story, having undergone a

remarkable structural transformation in recent years. The Survey notes that

electronics has climbed from the seventh-largest export category in FY22 to the

third-largest and fastest-growing by FY25. This surge has been driven by a

sharp rise in domestic production and exports, with the mobile manufacturing

segment at the centre of this expansion. Mobile phone production value

witnessed an extraordinary nearly 30-fold increase, rising from ₹18,000 crore in FY15 to ₹5.45

lakh crore in FY25, underscoring India’s emergence as a global manufacturing

hub for electronics.

The

pharmaceutical industry, another cornerstone of India’s industrial ecosystem,

continues to consolidate its global leadership. Ranked as the world’s

third-largest by volume, the sector meets around 20 per cent of global generics

demand and exported to 191 countries in FY25. The Survey notes that the

industry’s annual turnover reached ₹4.72 lakh crore in FY25,

with exports growing at a compound annual rate of 7 per cent over the past

decade, highlighting its resilience and expanding global footprint.

Overall, the

Economic Survey 2025-26 paints an optimistic picture of India’s industrial

sector, noting that strong momentum has been sustained despite an evolving and

uncertain global environment. It credits reforms in infrastructure, logistics,

ease of doing business and innovation systems for strengthening the foundations

of industrial growth. Looking ahead, the Survey emphasises that the next phase

of industrialisation will require a calibrated shift from a model focused

largely on import substitution to one centred on scale, competitiveness,

innovation and deeper integration into global value chains. Rather than

striving for complete self-reliance across all segments, the Survey argues that

India must build strategic resilience through diversification, deeper

capabilities and greater private sector investment in research and development,

technology adoption, skills and quality systems — laying the groundwork for

sustained and inclusive industrial growth in the years ahead.