THEBUSINESSBYTES

BUREAU

NEW DELHI, JANUARY 22, 2026

As the number of affluent

Indians grows, demand for spacious and amenity-rich 3BHK homes has surged

across major cities, driven by changing family structures, the need for

multifunctional living spaces, increased work-from-home adoption, and a

preference for future-ready housing. However, the rapid escalation of

residential prices, rising land and construction costs, and a supply skewed

heavily towards premium segments are pushing 3BHK homes beyond the reach of the

average buyer, according to the latest report by proptech firm Square Yards.

The

report, From

Aspiration to Reality: The Cost of Owning a 3BHK in India, reveals

that the average price of a new 3BHK across India’s top five metropolitan

cities has climbed to ₹2.7

crore. At an annual income of around ₹23

lakh, a buyer would need nearly 12 years of income to afford such a home.

Strikingly, this income level is close to the estimated threshold for entry

into India’s top 1% earners, underlining the severity of affordability stress

in large-home ownership.

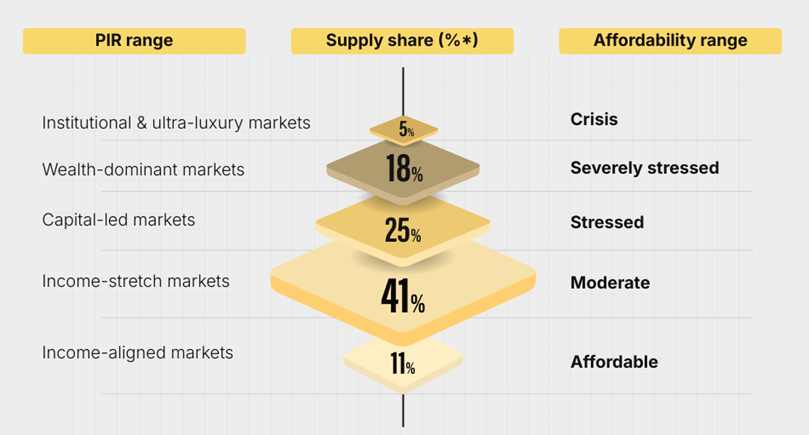

While

affordability pressures dominate, the study identifies emerging growth

corridors within cities as relatively income-aligned pockets offering better

value for 3BHK buyers. It points out that only 11% of new housing supply

currently falls within the affordable segment, while the remaining 89% is concentrated

in markets marked by elevated EMI burdens. Of this, 41% lies in

‘income-stretched’ zones, where financial stress on households begins to

intensify sharply.

City-wise

analysis shows Bengaluru as the most balanced market, with incomes broadly keeping

pace with property prices across corridors. In contrast, NCR and the Mumbai

Metropolitan Region exhibit sharp corridor-level disparities, making location

choice a decisive factor for buyers. Hyderabad, despite being a high-growth

market, has witnessed prices outstripping income growth, pushing most

residential hubs into high-stress categories. Pune, a preferred destination for

young professionals, remains wealth-dominated in its core areas, compelling

buyers to look towards peripheral locations for 3BHK affordability. The report

notes that selecting the right micro-market can translate into savings of ₹30–60 lakh, as central and

premium zones increasingly serve as wealth-preservation or capital-parking

destinations.

The

findings are based on an analysis of 10,500 RERA-registered 3BHK units launched

between 2024 and 2025 across 44 micro-markets in Bengaluru, Hyderabad, Mumbai

Metropolitan Region, NCR — including Noida, Gurugram and Greater Noida — and

Pune. The report offers a structured buyer playbook segmented by income

cohorts, with tailored guidance for first-time buyers, mid-income upgraders,

and high-net-worth individuals and investors.

Affordability

has been assessed using the price-to-income ratio (PIR), an OECD-referenced

metric that measures the number of years of household income required to

purchase a 3BHK. Based on this framework, markets are categorised as

income-aligned, income-stretched, capital-led, wealth-dominant, and

institutional or ultra-luxury.

The data indicate that 48% of

3BHK supply launched in the past year falls within stressed, severely stressed,

and crisis categories, where higher-priced segments tend to deliver stronger

returns. Developer profit margins in these markets range between 45–50%,

compared with 15–18% in income-aligned segments. “This concentration of premium

supply has coincided with a post-pandemic shift in buyer preferences towards

larger, amenity-rich homes by reputed developers. At the same time, a surge in

high-net-worth individuals in a favourable economic environment has placed 3BHK

affordability under significant pressure,” said Tanuj Shori, Founder and CEO,

Square Yards.