THEBUSINESSBYTES

BUREAU

BHUBANESWAR, JANUARY 27, 2026

India’s

emergence as the world’s fourth-largest economy stands as a testament to years

of sustained focus on domestic manufacturing, massive infrastructure expansion

and a deliberate effort to reduce import dependence in strategically critical

sectors. However, as the country positions itself for the next phase of

industrial acceleration and energy-led growth, a significant strategic gap is

becoming increasingly evident. Despite possessing abundant domestic reserves,

India continues to underutilise its bauxite resources—particularly in

mineral-rich Odisha—leaving a vital raw material inadequately leveraged at a

time when self-reliance, resilience and supply-chain security matter more than

ever.

The urgency

of addressing this challenge is underscored by recent developments in the

private sector. Hindalco’s proposed ₹8,000-crore greenfield

alumina refinery in Odisha represents a strong vote of confidence in the

state’s industrial potential and India’s long-term aluminium demand outlook.

The project is expected to strengthen the national aluminium ecosystem,

generate large-scale employment and catalyse downstream manufacturing. Yet, the

success of such investments hinges fundamentally on one indispensable input — a

secure, affordable and predictable supply of bauxite. Without unlocking

domestic bauxite resources at scale, even flagship industrial projects risk

becoming increasingly dependent on imported raw materials, exposing them to

global price volatility, freight disruptions and geopolitical uncertainties.

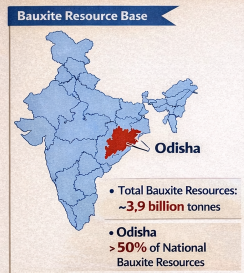

The scale of

opportunity that Odisha offers is both significant and strategic. India

possesses nearly 3.9 billion tonnes of bauxite resources, with Odisha alone

accounting for more than 50 per cent of this total. The state’s mineral-rich

districts — including Kalahandi, Koraput, Sundargarh, Bolangir and Sambalpur —

host some of the highest-grade bauxite deposits in the country. These reserves

form the backbone of aluminium production, a metal that has become

indispensable to electric vehicles, renewable energy infrastructure, railways,

construction, aerospace and defence manufacturing, all of which are priority

sectors for India’s growth story.

The scale of

opportunity that Odisha offers is both significant and strategic. India

possesses nearly 3.9 billion tonnes of bauxite resources, with Odisha alone

accounting for more than 50 per cent of this total. The state’s mineral-rich

districts — including Kalahandi, Koraput, Sundargarh, Bolangir and Sambalpur —

host some of the highest-grade bauxite deposits in the country. These reserves

form the backbone of aluminium production, a metal that has become

indispensable to electric vehicles, renewable energy infrastructure, railways,

construction, aerospace and defence manufacturing, all of which are priority

sectors for India’s growth story.

Yet, despite

this natural advantage, India’s reliance on imported bauxite continues to rise.

In FY2023, the country imported approximately 3.6 million tonnes of bauxite.

This figure increased sharply to around 4.5 million tonnes in FY2024 as

aluminium producers expanded capacity to meet growing domestic and export

demand. Trade data indicates that India sources bauxite from a diverse set of

countries, including Guinea and China, highlighting a deepening dependence on

external supply chains for a mineral that is available domestically in

substantial quantities.

This trend

carries tangible economic and strategic costs. Aluminium imports — encompassing

raw materials as well as semi-finished products — now account for more than

half of domestic consumption. Over the past five years, the value of

aluminium-related imports has climbed steadily, with estimates suggesting that

the import bill has approached ₹30,000 crore in FY2026. This persistent outflow of

foreign exchange strains India’s trade balance and leaves domestic

manufacturers exposed to geopolitical disruptions and global price

fluctuations. Such exposure runs counter to the

core objectives of *Atmanirbhar Bharat* and the Aluminium Vision 2047 released

by the Ministry of Mines, both of which underscore the need for resilient

domestic supply chains for critical industrial materials.

Demand-side

pressures are only expected to intensify in the coming years. Projections

outlined in Aluminium Vision 2047 indicate that India’s aluminium requirement

could exceed 8 million tonnes per annum by 2030, up from roughly 5.5 million

tonnes today. While domestic primary aluminium production has increased to

around 4.2 million tonnes in FY2025 and further capacity additions are planned,

sustained growth will be contingent upon assured access to raw materials —

something that continued reliance on imported bauxite cannot guarantee in the

long term. Given that producing one million tonnes of aluminium requires nearly

six million tonnes of bauxite, the imperative to scale up domestic bauxite

production becomes unavoidable.

India’s

growing import dependence is therefore not a reflection of resource scarcity,

but rather the outcome of structural and regulatory bottlenecks. Although

domestic bauxite production crossed 23 million tonnes in 2023, new mine

development has lagged due to prolonged delays in land acquisition,

environmental and forest clearances, and inadequate infrastructure development

in mineral-bearing regions. As a result, several economically viable deposits

remain underutilised, compelling producers to rely on imports to bridge supply

gaps despite the availability of domestic resources.

Environmental

and social considerations must remain central to any mining expansion strategy.

However, the solution lies in responsible acceleration rather than continued

inertia. Advances in monitoring technologies — including satellite surveillance,

remote sensing and real-time data analytics — allow for far stronger oversight,

transparency and regulatory compliance than ever before. Best-practice water

management, progressive mine closure planning and responsible tailings handling

can significantly mitigate environmental risks. Importantly, Odisha’s Mineral

Bearing Areas Development Corporation already provides a robust framework for

channeling mining revenues into local development, supporting investments in

healthcare, education, infrastructure and sustainable livelihood creation in

mining-affected communities.

Globally,

the race for resource security is intensifying at an unprecedented pace. China

continues to consolidate access to bauxite assets across Africa and other

regions, while several countries are fast-tracking domestic mineral exploration

and extraction to insulate their industries from supply shocks. In this global

context, India cannot afford prolonged hesitation or policy paralysis.

Unlocking Odisha’s bauxite resources through transparent, scientifically

managed and socially responsible mining is essential to safeguarding the

country’s industrial future.

The bauxite

beneath Odisha’s plateaus is far more than a geological asset. It represents a

strategic foundation for India’s manufacturing ambitions, economic resilience

and long-term global competitiveness. The time for cautious delay has passed.

What is required now is decisive, well-governed action to align India’s mineral

development strategy with its broader economic aspirations and ensure that

domestic resources power the nation’s next growth cycle.