THEBUSINESSBYTES

BUREAU

BHUBANESWAR,

JANUARY 11, 2026

India stands

at a decisive moment in its industrial evolution. Having recently emerged as

the world’s fourth-largest economy, surpassing Japan, the country’s growth

momentum has been propelled by a renewed thrust on domestic manufacturing,

infrastructure expansion and reduced import dependence. From electronics and

defence to renewable energy, policy initiatives aimed at strengthening local

value chains have begun to yield results. Yet, beneath this progress lies a

striking contradiction. Despite possessing vast reserves of bauxite — the

primary raw material for aluminium — India continues to rely heavily on imports

to sustain its expanding aluminium value chain. This paradox not only drains

valuable foreign exchange but also undermines strategic autonomy in critical

sectors such as defence, electric mobility, construction and clean energy,

while constraining job creation and regional development.

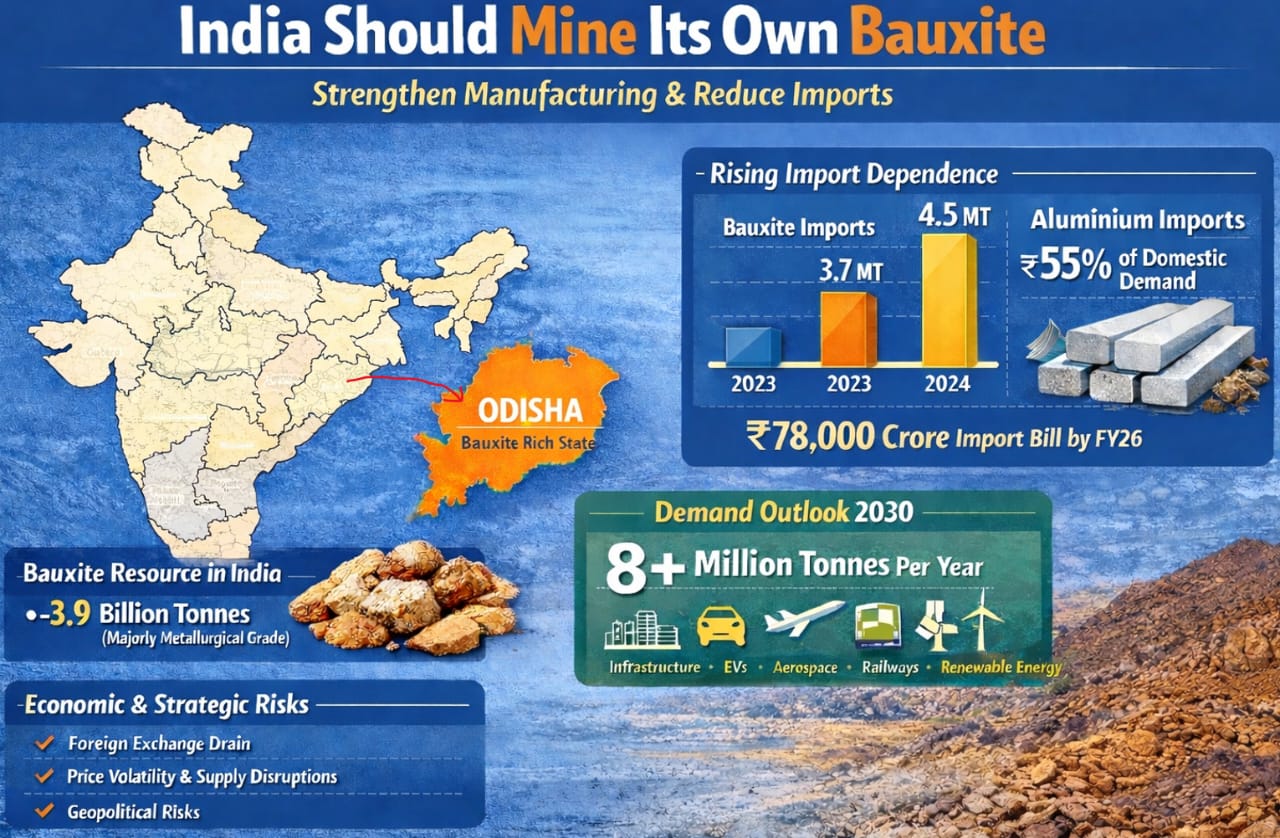

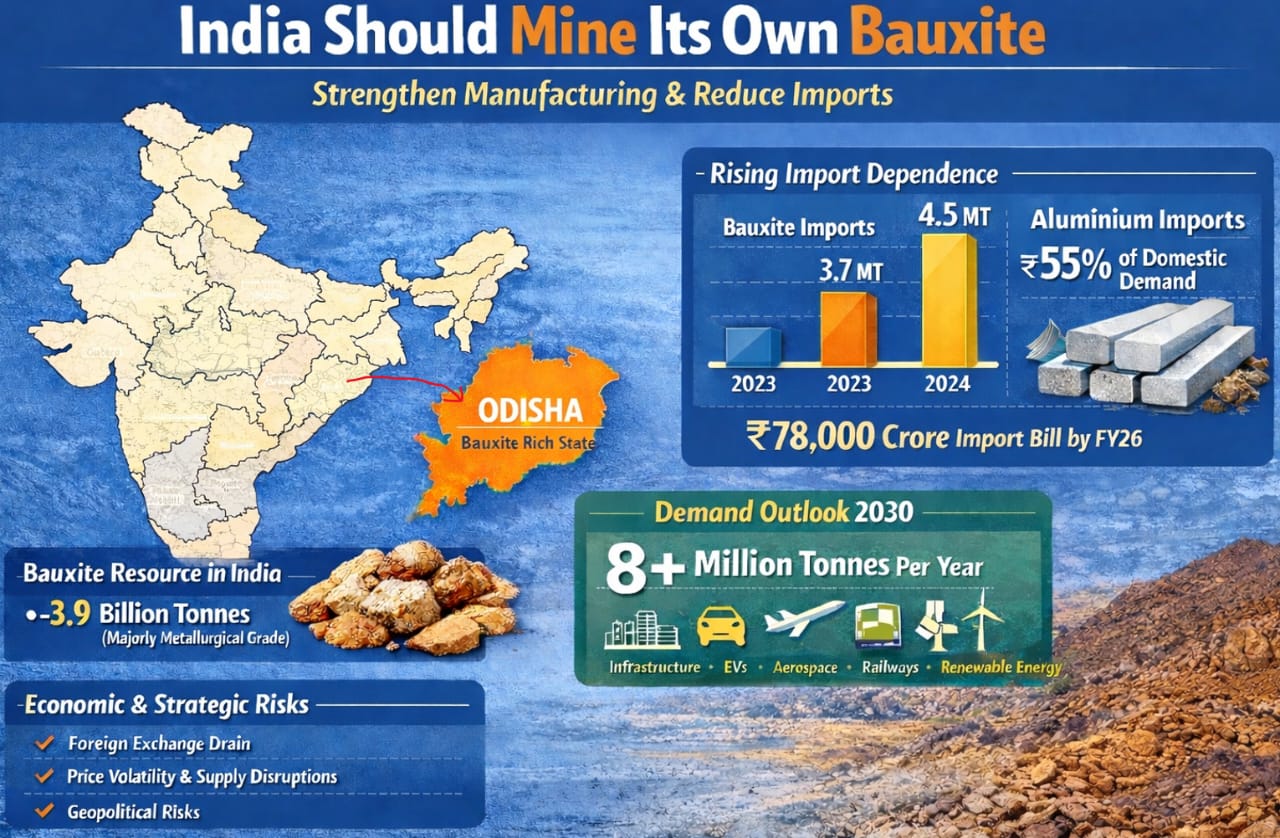

“India is resource-rich when it comes to

bauxite. Government and industry estimates place the country’s bauxite

resources at nearly 3.9 billion tonnes, a significant share of which is

metallurgical grade and suitable for aluminium production. These reserves are

spread across Odisha, Jharkhand, Gujarat, Maharashtra, and Madhya Pradesh, with

the eastern belt, particularly Odisha, emerging as the leading

bauxite-producing state. Districts such as Kalahandi, Koraput, Sundargarh,

Bolangir, and Sambalpur host some of the country’s richest deposits, offering a

strong foundation for long-term raw material security if effectively

harnessed”, said Dr. Sridhar Panda, former Professor of Geology, Berhampur

University.

Despite this

abundance, India’s bauxite imports have climbed steadily in recent years, signalling

a widening gap between domestic supply and rising demand. In 2023, the country

imported over 3.7 million tonnes of bauxite, about 6 per cent higher than the

previous year. The trend intensified in 2024, with imports jumping by nearly 20

per cent to more than 4.5 million tonnes as aluminium plants and downstream

industries expanded capacity. Trade data from 2025 further reveal thousands of

bauxite consignments arriving from countries such as Guinea and China, as well

as European trading hubs like the Netherlands, highlighting the depth of

India’s growing import dependence.

Dr. Panda

added, “The consequences of this reliance extend well beyond raw material

volumes. Aluminium imports, including semi-finished products, now account for

more than 55 per cent of domestic demand, imposing a cost of tens of thousands

of crores on the economy each year. Import values have reportedly risen by 72

per cent over the past five years, reaching nearly ₹78,000 crore in FY26. This sustained outflow of foreign

exchange exposes Indian manufacturing to global price volatility, supply chain

disruptions,

and geopolitical risks. Such vulnerabilities sit uneasily with national

ambitions under Atmanirbhar Bharat and the Aluminium Vision 2047 released by

the Ministry of Mines, both of which emphasise resilient domestic supply chains

for critical materials.”

Demand

pressures are set to intensify further as aluminium becomes increasingly

indispensable to modern infrastructure, electric vehicles, aerospace, railways

and renewable energy installations, owing to its light weight, strength and

recyclability. Projections under Aluminium Vision 2047 suggest that India’s

aluminium requirement could exceed 8 million tonnes per annum by 2030, up from

around 5.5 million tonnes currently. While domestic primary aluminium

production has reached about 4.2 million tonnes in FY2025 and major producers

are planning capacity expansions, long-term growth hinges on assured access to

raw materials — something imports alone cannot reliably ensure.

Demand

pressures are set to intensify further as aluminium becomes increasingly

indispensable to modern infrastructure, electric vehicles, aerospace, railways

and renewable energy installations, owing to its light weight, strength and

recyclability. Projections under Aluminium Vision 2047 suggest that India’s

aluminium requirement could exceed 8 million tonnes per annum by 2030, up from

around 5.5 million tonnes currently. While domestic primary aluminium

production has reached about 4.2 million tonnes in FY2025 and major producers

are planning capacity expansions, long-term growth hinges on assured access to

raw materials — something imports alone cannot reliably ensure.

“India’s reliance on bauxite imports is

therefore not a consequence of resource scarcity but a structural and policy

gap. Domestic bauxite production crossed 23 million tonnes in 2023, yet new

mine development has lagged due to complex land acquisition processes,

regulatory delays, and inadequate infrastructure in mineral-rich regions. As a

result, economically viable deposits remain underutilised while producers turn

to foreign ore to meet immediate needs. Streamlining approvals, investing in

logistics, strengthening community engagement, and adopting responsible mining

practices can unlock domestic reserves at scale and support long-term supply

security”, added Dr. Panda.

Reducing

import dependence offers dividends beyond economics. Aluminium is increasingly

recognised as a strategic metal, central to energy transition and national

security. Reliable access to domestic bauxite would shield India from external

shocks while catalysing employment, infrastructure development and value

addition in some of the country’s most underdeveloped regions.

With vast

reserves lying untapped and imports rising steadily, India now faces a clear

choice. Prioritising responsible and efficient domestic bauxite mining is no

longer optional — it is essential. For policymakers and industry alike, the

path forward is evident: sustainable industrial growth must be anchored in

India’s own mineral strength to secure long-term manufacturing resilience and

economic independence.