THEBUSINESSBYTES BUREAU

BHUBANESWAR, FEBRUARY 8, 2026

Odisha is entering a decisive phase in its economic journey. Recent

business summits have recorded investment intents exceeding ₹1 lakh

crore, reflecting strong momentum across manufacturing, metals and

infrastructure. The challenge now before policymakers is to translate these commitments into durable, long-term economic

gains while ensuring that growth reaches Odisha’s own regions — particularly

those that remain economically lagging despite their abundant natural

resources.

One of the most promising pathways to achieve this balance lies in the

strategic development of domestic bauxite resources.

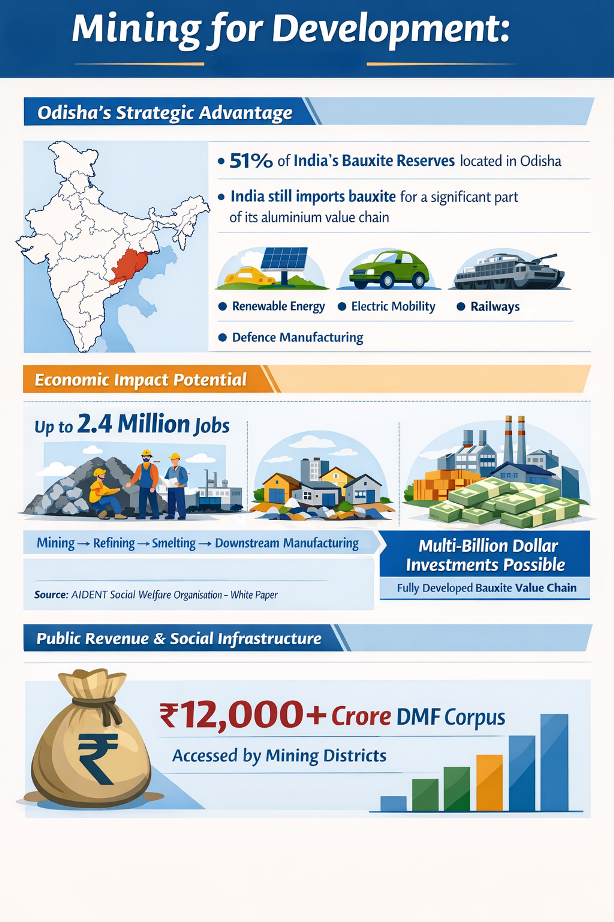

According to Dr Siba Mahakud, former Director of the Geological Survey of

India, Odisha accounts for nearly 51 per cent of India’s bauxite reserves,

making it the country’s most critical source of raw material for aluminium

production. Yet, a significant portion of India’s aluminium industry continues

to rely on imported bauxite, exposing manufacturers to global price volatility

and supply-chain uncertainties. With aluminium demand rising sharply — driven

by renewable energy, electric vehicles, railways and defence production — this

dependence underscores an opportunity India has yet to fully harness.

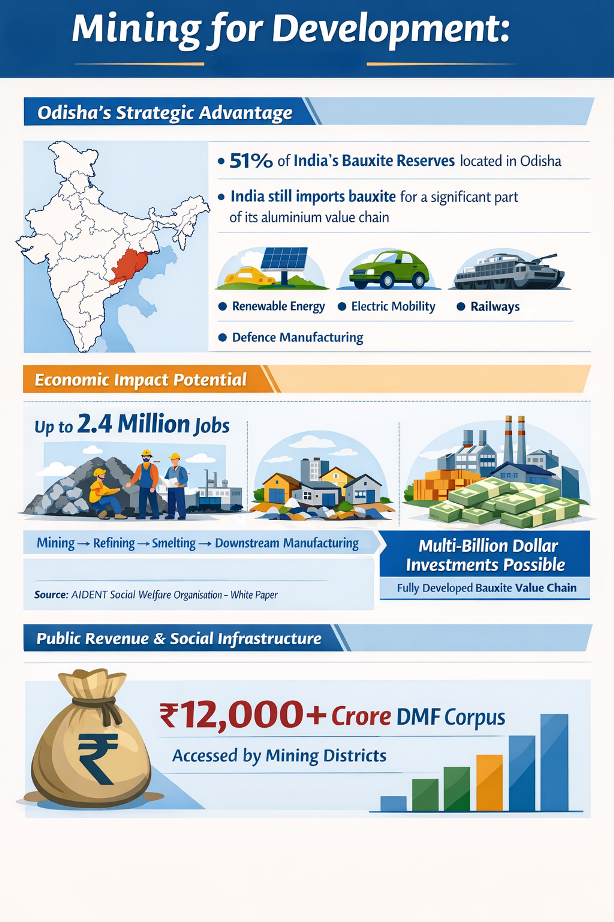

Beyond raw material security, bauxite development carries far-reaching

implications for employment and revenue generation. A recent white paper by

AIDENT Social Welfare Organisation (ASWO), a non-profit and non-partisan Indian

NGO, highlights that unlocking Odisha’s bauxite potential could create up to

2.4 million jobs across mining, refining, smelting and downstream

manufacturing. The study also estimates that more than 10,000 small and medium

enterprises could integrate into the aluminium ecosystem, while a fully

developed bauxite value chain could attract multi-billion-dollar investments into

the state over time.

Beyond raw material security, bauxite development carries far-reaching

implications for employment and revenue generation. A recent white paper by

AIDENT Social Welfare Organisation (ASWO), a non-profit and non-partisan Indian

NGO, highlights that unlocking Odisha’s bauxite potential could create up to

2.4 million jobs across mining, refining, smelting and downstream

manufacturing. The study also estimates that more than 10,000 small and medium

enterprises could integrate into the aluminium ecosystem, while a fully

developed bauxite value chain could attract multi-billion-dollar investments into

the state over time.

“These numbers matter most for

districts such as Kalahandi, Koraput, Rayagada and parts of Sundargarh — regions

that sit atop mineral wealth but continue to lag in income, infrastructure and

employment indicators,” said Dr Mahakud. “The aluminium value chain is

labour-intensive and geographically distributed. Mining generates direct

employment, while refineries, transport networks, maintenance services,

fabrication units and logistics hubs create sustained indirect jobs.”

Kalahandi offers a glimpse of how this transition can unfold. Once known

primarily for distress and migration, the district has witnessed gradual

economic diversification following industrial activity. The growth of ancillary

businesses, service enterprises and non-farm livelihoods has been documented

around industrial clusters, reducing dependence on subsistence agriculture and

daily wage labour while encouraging local entrepreneurship.

Revenue generation is another critical dimension of mining-led

development. Mining and downstream processing contribute through royalties,

taxes and local economic activity. Odisha already channels mining-linked funds

through the District Mineral Foundation (DMF), which supports healthcare,

education, drinking water, roads and livelihood programmes in affected

districts. The AIDENT white paper notes that mining districts have collectively

accessed a DMF corpus exceeding ₹12,000 crore, funding

hospitals, schools, mobile health units and women-led self-help group

enterprises.

Environmental and social considerations remain central to any expansion

of mining activity. The key question today is not whether bauxite should be

mined, but how. Advances in environmental monitoring, digital compliance

systems and clearer mine-closure norms have strengthened regulatory oversight.

When combined with transparent governance and meaningful community

participation, responsible mining can balance ecological protection with

economic development.

Globally, competition for critical minerals is intensifying, and recent supply-chain disruptions have highlighted the risks of import dependence. For India, strengthening domestic aluminium supply is an economic necessity. For Odisha, it represents a significant development opportunity.

As the state works to convert investment intent into on-ground growth, the responsible development of domestic bauxite can play a pivotal role — creating jobs, generating revenue and driving regional progress in districts that need it most. Done right, mining can move beyond extraction to become a foundation for inclusive and durable development.