THEBUSINESSBYTES BUREAU

NEW DELHI, FEBRUARY 22, 2026

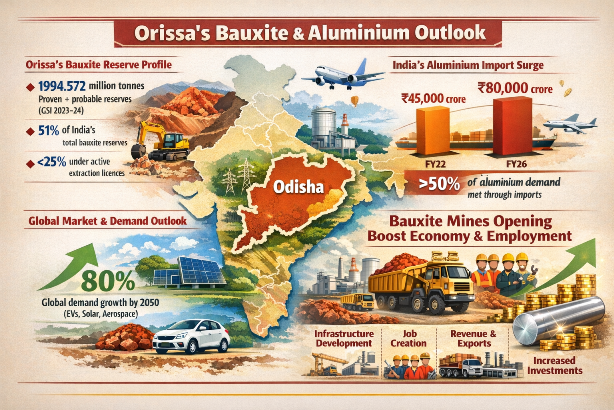

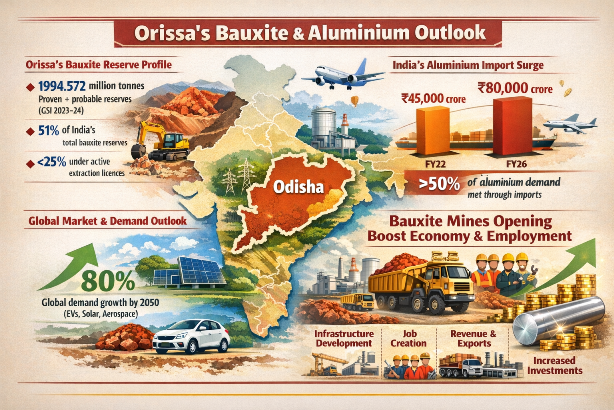

India’s growth trajectory is increasingly intertwined with aluminium — a strategic metal that underpins infrastructure, defence, renewable energy, electric mobility and advanced manufacturing. Yet a persistent contradiction remains: despite possessing abundant bauxite reserves, the country continues to depend on imports to sustain its aluminium value chain.

India’s bauxite resources are estimated at nearly 3.9 billion tonnes, but

imports have shown a steady upward trend. In FY23, bauxite imports were

recorded at 3.6 million tonnes, rising further to 4.5 million tonnes in FY24.

This continued reliance on overseas supplies, despite substantial domestic

reserves, represents a structural vulnerability. It exposes the sector to

global price volatility, shipping disruptions and geopolitical uncertainties —

risks that are becoming more pronounced in an increasingly fragmented global

trade environment.

Dr. Madhumita Das, Ex Professor, Geology, Utkal University, said, “The

urgency becomes clearer when viewed through the lens of demand. Aluminium

consumption in India is currently around 5.5 million tonnes per annum, and is

projected to exceed 8 million tonnes by 2030. This surge will be driven by the

expansion of renewable energy capacity, electrification of transport, smart

grids, and large-scale infrastructure development. Meanwhile, primary aluminium

production in FY25 is estimated at around 4.2 million tonnes, highlighting the

need to strengthen domestic capacity and raw material linkages. The economic

implications of this gap are already visible. India’s aluminium import bill is

expected to touch nearly ₹30,000 crore by FY26, a substantial outflow that

could otherwise support domestic investment, job creation and industrial

competitiveness.”

Dr. Madhumita Das, Ex Professor, Geology, Utkal University, said, “The

urgency becomes clearer when viewed through the lens of demand. Aluminium

consumption in India is currently around 5.5 million tonnes per annum, and is

projected to exceed 8 million tonnes by 2030. This surge will be driven by the

expansion of renewable energy capacity, electrification of transport, smart

grids, and large-scale infrastructure development. Meanwhile, primary aluminium

production in FY25 is estimated at around 4.2 million tonnes, highlighting the

need to strengthen domestic capacity and raw material linkages. The economic

implications of this gap are already visible. India’s aluminium import bill is

expected to touch nearly ₹30,000 crore by FY26, a substantial outflow that

could otherwise support domestic investment, job creation and industrial

competitiveness.”

The foundation of aluminium self-reliance lies upstream — in bauxite.

Producing one tonne of aluminium requires approximately six tonnes of bauxite,

making secure raw material availability essential for sustaining long-term

growth. Without reliable access to domestic bauxite, ambitions to expand

aluminium capacity and reduce dependence on imported finished metal will remain

constrained.

In this context, Odisha assumes strategic importance. With more than 50

per cent of India’s bauxite reserves — concentrated in districts such as

Kalahandi, Rayagada, Koraput, Sundargarh, Bolangir and Sambalpur — the state

holds the key to reducing import dependence and building resilient supply

chains. Domestic bauxite production has already crossed 23 million tonnes in 2023,

but unlocking the full potential of these reserves could significantly enhance

India’s resource security. Expanding domestic mining is not merely an

industrial necessity; it is also a major economic opportunity, said Dr.

Madhumita Das, Ex Professor, Geology, Utkal University.

Stronger local sourcing supports employment, increases state revenues,

strengthens downstream manufacturing and reduces exposure to external supply

shocks. It also lowers the carbon footprint associated with long-distance

transportation of imported raw materials. Atmanirbhar Bharat cannot be achieved

through downstream production alone. Strategic autonomy in critical sectors

must begin with securing raw materials domestically and building integrated,

resilient supply chains. Reducing import dependence in aluminium is not simply

a trade correction; it is a strategic imperative linked to economic

sovereignty.

If India is serious about building durable industrial strength, aluminium

self-reliance must begin at the source — and domestic bauxite must form the

bedrock of that national ambition.